Capgemini together with BNP Paribas have published their much anticipated World Payments Report 2018. The World Payments Report is an annual report highlighting key payment trends across the globe. Key drivers, such as incumbent financial institutions, fintech companies, technology, changing customer expectations and regulation, are steering the industry through exciting times. All of which makes this annual report all the more interesting.

Read the World Payments Report 2018 for full details, but see below a quick summary and the World Payments Report infographic.

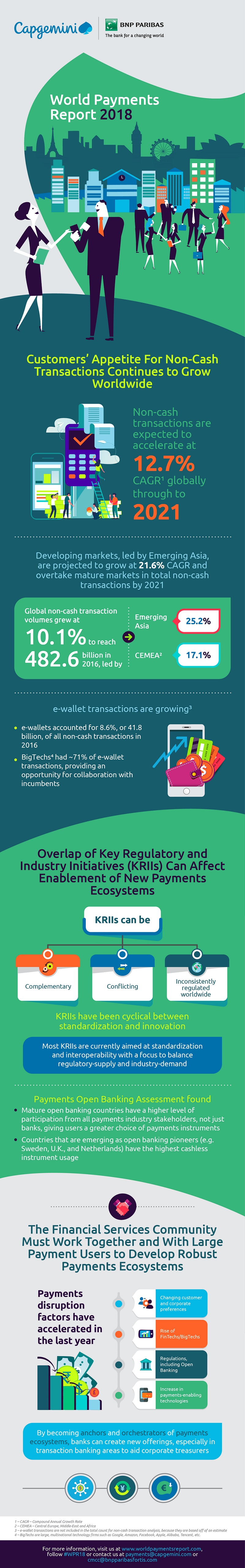

1.) Global Non-cash Payment Volumes are Growing

- In 2016-2016 non-cash payment volumes grew by 10.1%

- Emerging Asia (25.2%) and CEMEA (17.1%) were the main contributors to this growth as nations look to increase financial inclusion, and the adoption of mobile payments also increased

- The fastest growing non-cash countries are Russia, India, China and South Africa

2.) Most non-Cash Transactions are via Payment Apps / eWallets

- e-Wallet transaction volumes were around 41.8 billion in 2016, approximately 8.6% of all non-cash transactions

- 71% of non-Cash Transactions in 2016 were via Payment Apps / eWallets

- BigTechs – Google, Amazon, Facebook, Apple, Alibaba, Tencent – had the lions share of this

3.) Understand Key Regulatory and Industry Initiatives (KRIIs)

- Key Regulatory and Industry Initiatives (KRIIs) typically move from a region and become global, and as a result require strong standards and inter-operablility initiatives to harmonise fragmented markets

- Regulation implemented correctly can encourage Payment Service Providers to innovate by piloting new technologies (Instant Payments, Blockchain, Regulatory Standards and Application Programming Interfaces) to improve customer satisfaction and support collaboration across the ecosystem

- Some KRIIs create confusion, duplication and conflicts which in turn hinder innovation and collaboration

4.) Technology & Innovation offer Banks new Product, Services & Collaboration Opportunities

- Open banking, new payment service provider entrants, new technology, shifting customer expectations and BigTechs are all disrupting in an accelerated manner the payments landscape

- Capgemini and BNP Paribas believe banks must play an anchor role;

- Utilising “new” technologies (APIs, Distributed Ledger Technologies, Artificial Intelligence, Internet of Things, Blockchain) and understand their transformational power

- Innovate and offer new customer focused services and products

- Collaborating with new service providers, Fintech and other key stakeholders

- Fintech companies offer incumbent financial institutions:

- Easy access to modern technology

- A wealth of innovative ideas and an opportunity to explore ideas and proof of concepts

- Agility to move faster

- An enhanced customer journey and experience

- Access to modern analytical tools

- While incumbent financial institutions offer Fintech companies

- Access to a large customer base and product / service distribution network

- A well known and trusted brand name through whom Fintech’s can offer their products and services

- Guidance to navigate regulatory hurdles

Pingback: 10 Awesome 2019 Retail Banking Trends by Capgemini