APIs are at the heart of the PSD2 and Open Banking revolution, yet many folks don’t really know what APIs actually are. Its worth noting that web based APIs have been around since 2000. In this post, i share what i learnt about APIs, all of which i think is crucial to help you in your discussions with folks about PSD2, Open Banking and how APIs can help your business. If you feel i have missed something important, please do let me know if the comments below.

API Technical Gobbledygook:

Okay, lets start with the technical stuff. You will have heard some of the following terms during discussions about APIs.

- API stands for Application Programming Interface

- API’s (out of the box) exchange data from one system to another using JSON or JavaScript Serial Object Notation

- There are 2 types of APIs

- REST – REpresentational State Transfer

- SOAP – Simple Object Access Protocol

- APIs are used in many different ways:

- Web APIs

- Private APIs

- Third Party APIs

Now, lets understand what it all means….

APIs Are Just Like Waiters at a Restaurant…

The API/waiter analogy has been written about a lot, but it is an incredibly simple and effective way of understanding APIs.

So, imagine the waiter is an API. The waiter (API):

- Takes an order from a customer, who has read the available options from a menu

- Goes to the kitchen with the customers request and asks the chef to prepare the food according to the customers requirements

- Once prepared, takes the food from the kitchen to the customer

The API is an interface through which you make specific requests and receive a corresponding response. The buzz API phrase you often here is request and response.

The Difference between Private APIs and Public APIs

Its probably stating the obvious, but:

- Public APIs are openly available APIs that we use when we use apps such as Twitter, Facebook, Google Maps

- Private APIs are APIs that are used within an organisation, or with authorised partners only

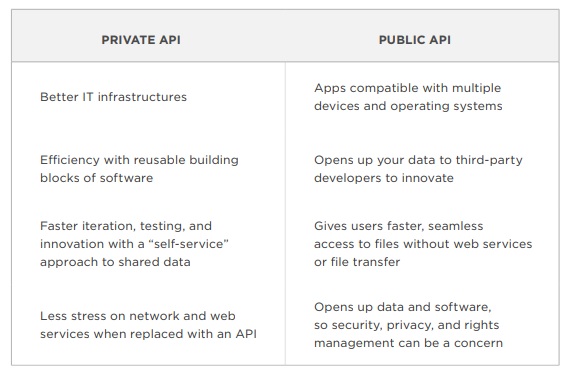

The following table from Upwork nicely summarises the pros/cons of Public and Private APIs:

The Difference between REST APIs and SOAP APIs

Now things get pretty technical, so to keep things simple you need to know that there are 2 types of APIs:

- REST – REpresentational State Transfer

- SOAP – Simple Object Access Protocol

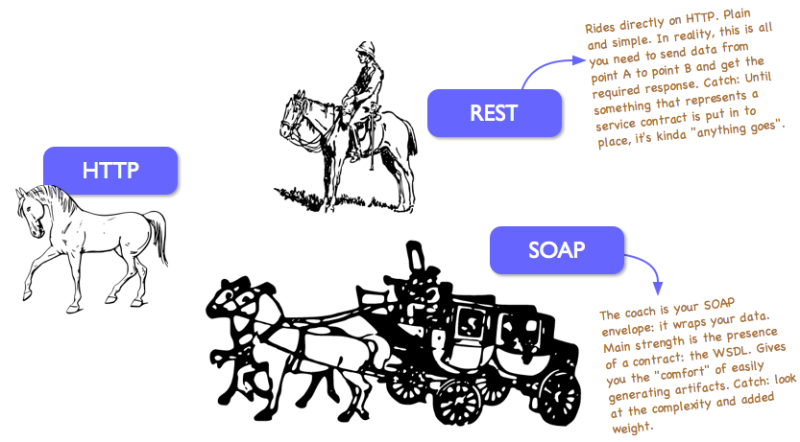

SOAP APIs have been around for sometime, while REST APIs are fairly new and seek to simplify the way in which the APIs access web services. In the interests of keeping things simple, i thought i would share a couple of images that nicely capture the differences:

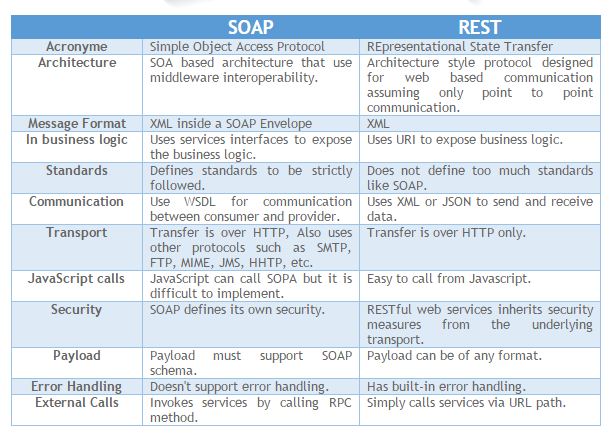

And following are the technical differences between REST and SOAP APIs:

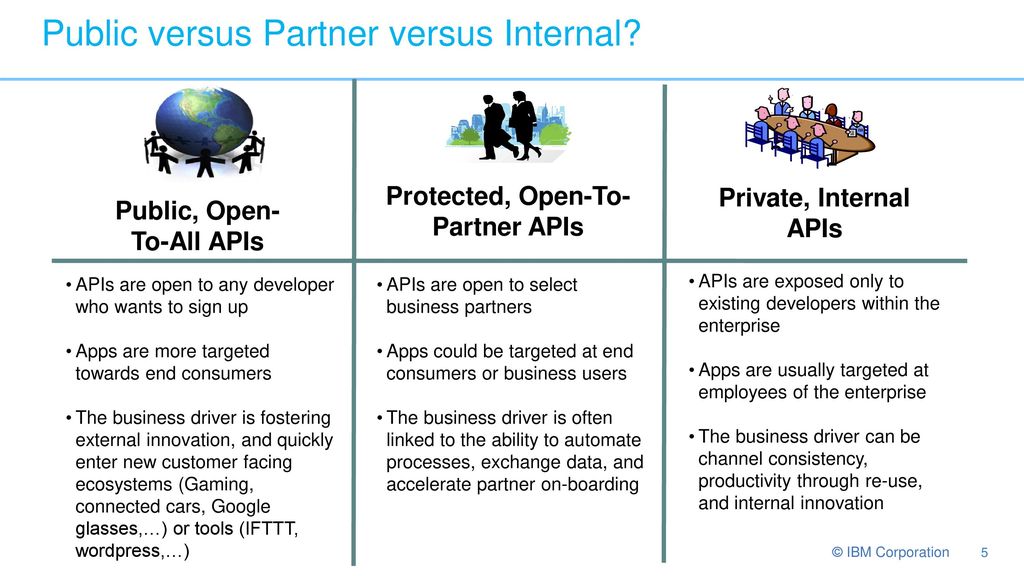

The Difference between Public and Private APIs

In short:

- Public APIs are available to any developer that is interested

- Private APIs are exposed to developer community within a specified organisation only

- Partner APIs are available to nominated organisations only

Check out the following table for further details:

APIs Enable Innovation and Collaboration

Another way to see APIs are as enablers of innovation and collaboration. The motivation for API technology is to have an open ecosystem that is standardised and allows you to make use of multiple solutions. APIs particularly public APIs, allow companies to use available APIs without needing to go through a rigorous internal development process. As such APIs encourage innovation and experimentation among the developer community, all of which serves to improve the product/solution. And while they may not quite be plug and play, it is the relative ability to do that with multiple providers and solutions that make APIs an attractive prospect.

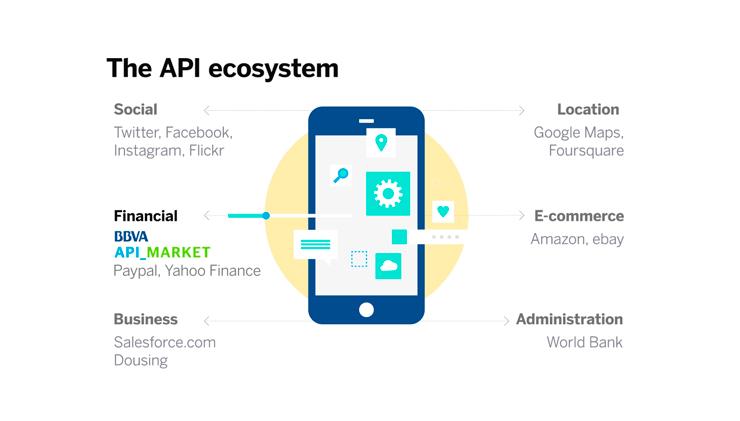

Think about how many solutions are enabled through APIs – ordering a pizza,, booking a hotel, ordering a taxi, finding your way from a train station to a hotel, sharing pictures and status via social media – all of which are easily and seamlessly plugged into applications and websites. The following image from BBVA nicely captures the way in which APIs have penetrated everyday life:

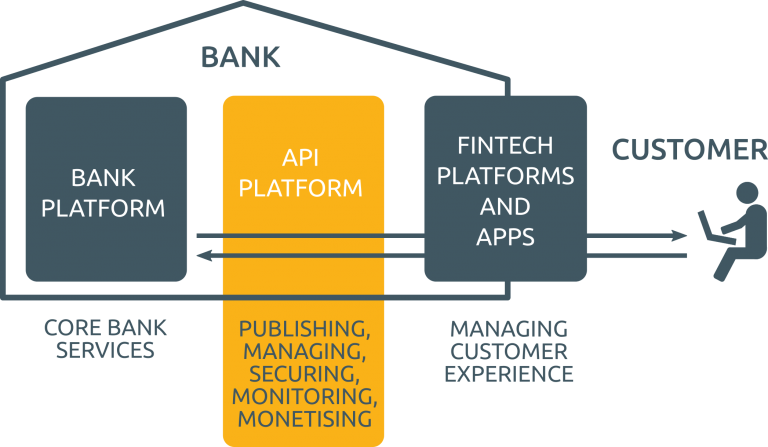

APIs and Open Banking

Lastly, lets bring it all back to open banking. The following groups will interact with banks using APIs:

- TPP – Third Party Payment Service providers

- ASPSP – Account Servicing Payment Service Providers

- AISP – Account Information Service Providers

- PISP – Payment Initiation Service Providers

Hope that helps! 😉

References:

Pingback: Key Facts & Figures from the EBF Banking In Europe 2017 Overview

Pingback: 4 Top Trends from the World Payments Report 2018 (Infographic)

Pingback: 10 Flippin Fantastic 2019 Fintech Trends by McKinsey

Pingback: Happy Birthday Open Banking, Happy Birthday To You!!

Pingback: Gorgeous Guide to PSD2 - Payment Services Directive

Pingback: Preparing for Open X - The World Fintech Report 2019 by Capgemini

You mentioned that public API’s are API’s that everyone has access to. What would API’s be called that you can download, but can only access the fullness of the app with logins? Would those be considered closed API’s?