In this post, i will summarise the Capgemini Top Trends in Payments 2023. There are 10 key 2023 Payment Trends you need to know about, and the report is a must read for further details and insights. Let’s dive straight in…

10 Payment Trends for 2023:

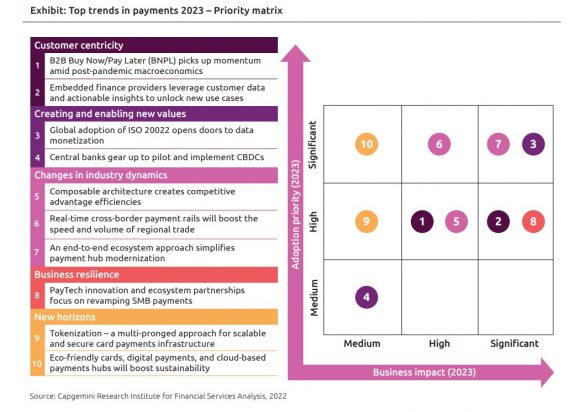

The Capgemini Payment Trends Report highlights 5 broad themes that capture what is happening across the landscape:

- Customer Centricity

- Creating & enabling new values

- Changes in industry dynamics

- Business resilience

- New horizons

Payment Trends 1: Buy Now/Pay Later (BNPL) Heats Up

- The BNPL trend, according to Capgemini, is the growth of Business to Business (B2B) Buy Now/Pay Later schemes. Buy Now/ Pay Later initiatives (BNPL) – enabling customers to spread the costs/defer payments, while ensuring the supplier is paid upfront – are proving popular due to various macroeconomic factors such as political tensions, inflation (cost of energy, materials), market volatility, supply chain and cross border trade disruption.

Payment Trends 2: Embedded Finance Taps into Data & Analytics

- Here Capgemini speak about how embedded finance, that is merging software with commerce business models, enables the use of data to present customers with products and services “at the right time”. Data is providing firms with incredible insights to their customers, and driving new lines of services and products.

Payment Trends 3: ISO20022 Value

- Aaaah, our favourite topic – ISO20022! In short ISO20022 adoption will improve efficiency (speedier/automated reconciliations), enable automation (Payments STP), drive value added solutions (enabled through structured data) and improve payment processing times (improved compliance checks, fewer payment disputes)

Payment Trends 4: Central Banks dive into CBDCs

- The decline in cash payments, surge in digital payments and growth of crypto is driving authorities around the world to look at Central Bank Digital Currencies (CBDCs). 100 out of 112 countries are pursuing CBDC research and implementation. I will be writing more about CBDCs in the coming weeks and months, so please excuse the brevity here…

Payment Trends 5: Composable Architecture advantages

- Capgemini detail composable architecture as a LEGO type model where firms are able to select/build/assemble solutions that meet their customer needs – this is all about streamlining processing, optimising time and cost). This could be through a combination of enhancing existing systems/process, developing in-house solutions or buying plug & play products from third party providers.

Payment Trends 6: Real Time Cross Border Payments drive regional trade

- The drive to improve domestic payment processing is now turning cross border, where it is widely acknowledged there are inefficiencies. Real time initiatives combined with ISO20022 implementations and the growth in DLT (Distributed Ledger Technology) is enabling a ripe environment to improve cross border payments. Key benefits highlighted by Capgemini are:

- Speed of payments

- Improved Liquidity

- Reduced costs

- Better transparency

- Greater security

Payment Trends 7: Payment Hub Modernisation

- Drivers in the implementation of a Payment Hub solution include:

- Consumer convenience demands where payments, across various channels, are seamless and secure

- Cost inefficiencies due to legacy, siloed and fragmented systems

- Cloud based solutions lowering cost and implementation barriers #

- API based architecture enabling interoperability, automation, security and data analytic capabilities

Payment Trends 8: SMB Payments focus

- Small and Medium sized Businesses (SMB) represent about 90% of global companies and as a result, according to Capgemini, “are wielding more clout”. Rightly so, and as a result SMBs are wanting improved solutions around payments, cash management services, regulatory openness and technology enhancements

Payment Trends 9: Tokenisation

- The goal of tokenisation is to improve data security by making card payments safer. With the growth of digital payments has come a huge growth in card fraud with tokenisation being seen as the solution. This is where sensitive information is no longer stored on the physical card, rather this is moved to a token which is linked to a token vault – more on this in another post soon!

Payment Trends 10: Sustainability focus

- Errrmmmmm…. I’m not sure about this one, but lets go with it. Capgemini state traditional payment processes (cash – use of plastic and paper, cards – elimination of single use cards to recycled/degradable cards, cheques – think deforestation) all have an environment impact. Essentially non-cash related payments are believed to reduce the overall carbon footprint.

The Capgemini 2023 Payment Trends Report is a must read report, and highlights the key drivers that are influencing and driving the evolution of payments, and more importantly the links between these payments trends.