Before we get into the ECB Bitcoin story, couple of things to say – 1.) Yes, I know this is ‘old’ news, I am catching up and sharing what i have spent this weekend reading about & 2.) Don’t shoot the messenger 🙂

As regular followers know, I’ve been ‘offline’ for a while and am now catching up with all things Europe, payments, Swift and key global payment trends that corporates need to be aware of. As i delve into these areas particularly European payments, Bitcoin keeps coming up. Following are the European Central Bank communications that i reference in this post:

- Bitcoin’s Last Stand

- Crypto dominos: the bursting crypto bubbles and the destiny of digital finance

- Caveat emptor does not apply to crypto

It’s worth noting from the outset the ECB crypto position is based on the following position:

“The philosophy behind cryptos is that digital technology can replace regulated intermediaries and avoid state “intrusion”. In other words, that it is possible to build a trustless but stable financial system based on technology.”

The ECB critique is carefully articulated and relates to “unbacked crypto-assets”. With that, let’s dive into the reason why the ECB believe Bitcoin is on the road to irrelevance:

1. Value Fluctuations, Bursting Bubbles in the Wild West

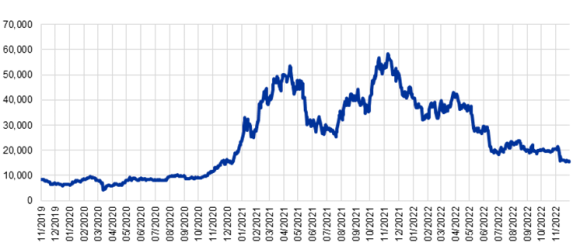

At the time of the “Bitcoin’s Last Stand” article the ECB outlined since the Bitcoin USD 69,000 high of November 2021 the cryptocurrency has fluctuated around the USD 20,000 mark. This should not be seen as stability rather “an artificially induced last gasp before the road to irrelevance”, and events such as the FTX collapses were just further examples and indicators of that journey…

In a speech by Fabio Panetta, he describes crypto as the “wild west” and suggests its not a bubble that is bursting, rather a froth that is emerging with multiple bubbles (and we all know what happens to bubbles!).

2. “Bitcoin is rarely used for legal transactions” – ECB

Wow, those are some strong words. The ECB recognise the objectives of Bitcoin are to address shortcomings in the current centralised monetary and financial system, and how that led to the cryptocurrency being branded as a “global decentralised digital currency”.

The ECB don’t mince their words, stating Bitcoin design and technological limitations cast doubts on the digital currency as a method of retail or wholesale payments. The ECB indicate Bitcoin is not an appropriate investment, “…does not generate cash flow (like real estate), or dividends (like equities), cannot be used productively (like commodities) or provide social benefits (like gold)”. As a result Bitcoin valuation is based on speculation alone, and the resulting speculative bubble is nourished and hyped by Bitcoin investors.

Fabio Panetta goes further describing how unbacked-crypto assets creates a societal imbalance between resource (human, finance, technology) consumption and a lack of “any” social/economic usefulness! Actually, Fabio indicates quite the opposite – stating the environment damage caused by unbacked crypto-assets and their use among criminal/terrorist activities and tax avoidance.

3. Bitcoin should not be legitimised & considered a valid asset

This point speaks to regulation. The ECB highlight the number of crypto lobbyists in the US has doubled from 115 in 2018 to 320 in 2021, the lobbyists (funded by Bitcoin investors) in turn schmooze lawmakers and regulators.

The ECB propose regulation is inconsistent for a couple of reasons:

- The manner in which regulation is discussed and implemented varies across regions, sometimes even within regions, and is moving at different speeds

- The underlying sentiment is that technology/innovation has to be given space to flourish, and Bitcoin and the underlying blockchain technology could have “high transformational potential”

- A misconception of Bitcoin regulation has led some financial institutions to ease access to Bitcoin, and therefore gives the impression Bitcoin investments are okay!

- Interestingly the ECB then move to highlight the harmful polluting impact of Bitcoin, and state the inefficiency of the Bitcoin is part of the system by design – i.e. ensuring the validity of the decentralised system

Hmmm, so what are YOUR thoughts?

Are unbacked crypto-assets such as Bitcoin nothing more than “speculative assets”, a bit of a gamble? Do unbacked crypto-assets offer any societal benefits, and why do you think the ECB has taken such a strong stance? Is regulation the answer to protect individuals from the financial risks associated with unbacked crypto-assets? What is the right balance to strike between technology, innovation and financial stability… a central bank, perhaps?