Yes guys, I am still around! My sincere apologies for the silence for the last year or so. I have been dealing with a couple of things, which i hope are now firmly in the rear view mirror. You may be wondering, why am i posting today? Well, this is a momentous moment (is that even a phrase?!?) for all SWIFT users – while the spotlight is on financial institutions, corporates need to know what is going on and prepare themselves for the SWIFT CBPR+ initiative. With that, lets dive straight into SWIFT CBPR+

1. What is SWIFT CBPR+ ?

- SWIFT CBPR+ is the SWIFT Cross Border Payments and Reporting initiative to go live, in the interbank space, with ISO 20022 (XML) standards

- This migration to SWIFT CBPR+ is happening right now, this weekend (18-19th March, 2023), and is being activated across all financial institutions on the SWIFT network

- Messages in scope for this ‘first phase’ through to November 2025 are:

- MT1 series

- MT2 series

- MT9 series

- From tomorrow we will enter what is being referred to as a ‘co-existence period’ where both MT and MX messages can be exchanged, after November 2025 the MT messages for the above series will be obsolete

- Industry experts are referring to this initiative as the first major global update to the SWIFT network in over 40 years

2. Why are SWIFT embarking on SWIFT CBPR+

Well, some say its make or break time for SWIFT, SWIFT need to embrace the latest and greatest standards – and more importantly need to standardise/harmonise the formats/data exchanges across financial institutions (FI’s) and financial market infrastructures (FMI’s).

SWIFT CBPR+ is being fast tracked by various financial market infrastructures moving to ISO 20022. for example:

- TARGET2 – 20th March, 2023

- EBA Clearing – 20th March, 2023

- UK CHAPS – 19th June, 2023

- Fedwire – 10th March, 2025

3. SWIFT CBPR+ Timeline

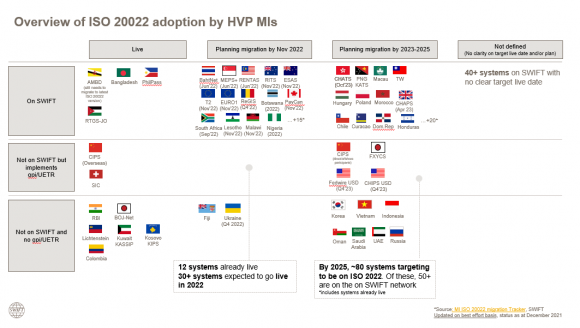

The following picture (slightly out of date) from SWIFT is quite interesting as it highlights the wider financial ecosystem move to ISO20022

4. How are Corporates Affected by SWIFT CBPR+

This is where it gets interesting…

- SWIFTs CBPR+ overview indicates “bank-to-corporate and corporate-to-bank message exchanges within the Standardised Corporate Environment (SCORE) are not in scope of the ISO 20022 adoption programme.”

- As a result SWIFT CBPR+ should not impact corporates using formats exchanged within SCORE – think MT101, MT940, MT942

- Corporates should be able to exchange SCORE messages as normal, but if you’re sending/receiving some messages that are not part of the arrangement – you maybe impacted…

But corporates need to be prepared for SWIFT CBPR+ and the migration to ISO 20022 XML (chances are you’re already on the journey)….

5. What can Corporates do to prepare for SWIFT CBPR+

- Ensure you understand all SWIFT messages your organisation is exchanging over the SWIFT network (most importantly which MT1*, MT2*, MT9* series messages)

- Which systems are sending / receiving these messages

- Work with your internal IT department or system vendor to understand if these systems have a ISO 20022 migration path

- Document which banks you’re exchanging these messages with, and understand if the bank will continue to support the inbound/outbound messages

- Consider implementing SWIFT ‘In-Flow Translation Service’, where you receive the multi-format – both the MT and ISO 20022 MX message, this application will split out (if that’s what you want) the MT piece of the message so your systems can continue to run without impact

- Reach out to SWIFT and understand your SWIFT User Category – for example you may be a corporate, but perhaps you’re exchanging special financial messages which required you to register as something other than SCORE (SWIFT for Corporates)

- Don’t think of this as a SWIFT CBPR+ project, rather recognise the benefits of migrating to ISO20022

I think another change will be receiving richer camt53 reports instead of MT940