It’s that time of the year where folks are thinking about 2019 and what will be the hot payment trends of the new year. Funnily enough following on from the recent post 10 Awesome 2019 Retail Banking Trends, Bill Sullivan shared the recent Capgemini report detailing the 10 Top Payment Trends for 2019. Read the report for full details, below is a quick summary.

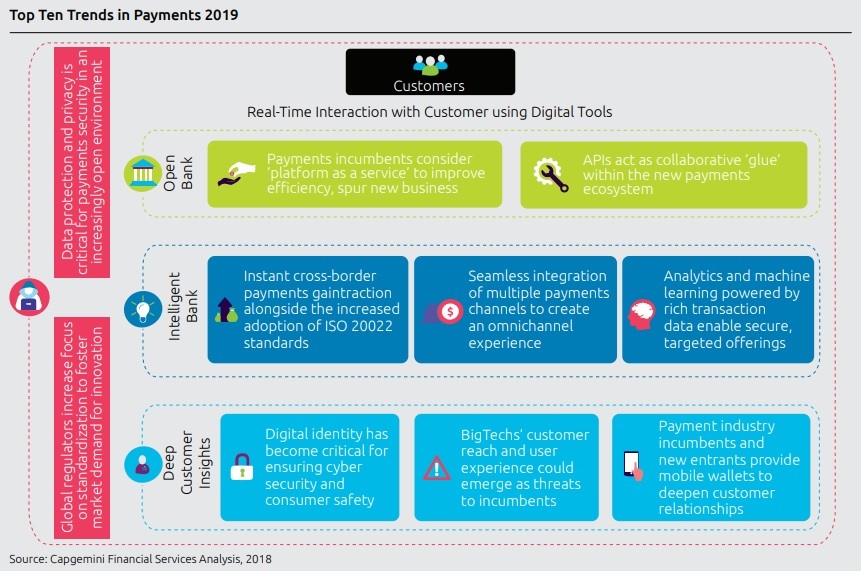

Key Payment Themes:

- Open Bank

- Intelligent Bank

- Deep Customer Insights

- Real Time Interaction with the Customer via Digital Tools

Open Bank –

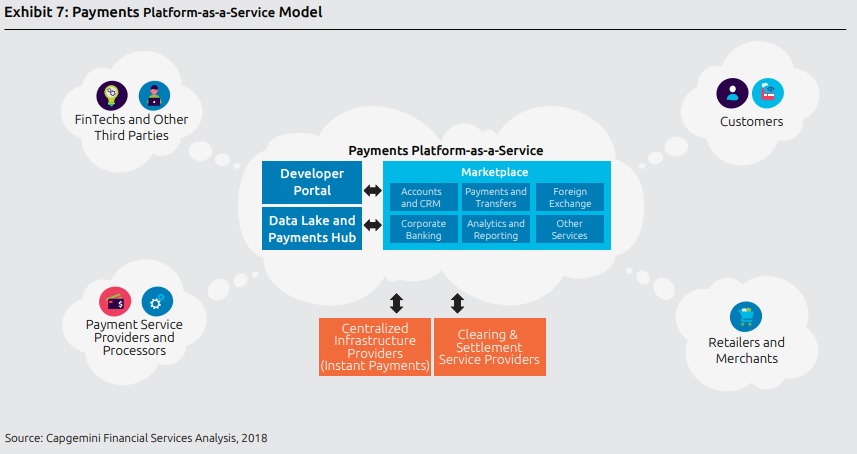

Payment Trend 1: Platformication

- “Platformication” or “Platform As A Service” will be used by incumbent payment service providers as a way to become more efficient and give rise to new products and services

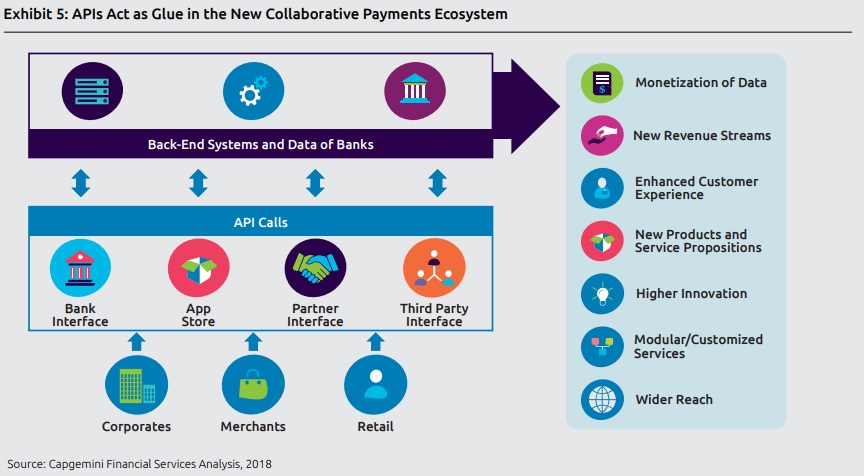

Payment Trend 2: Collaboration + Ecosystem = APIs

- APIs will enable collaboration within the ecosystem and connect different players and solutions

Intelligent Bank –

Payment Trend 3: Enabling Personalised Valued Added Services (VAS)

- Data analytics and machine learning coupled with improved transaction data will enable personalised value added services and cross selling opportunities

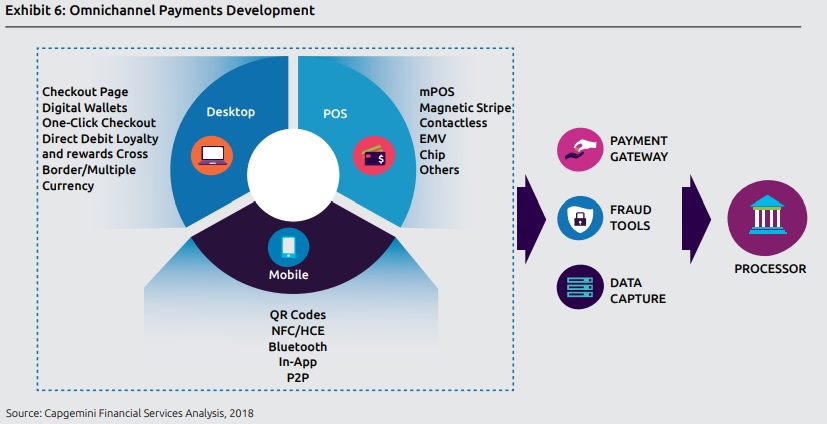

Payment Trend 4: Omnichannel Experience

- Fusion of various payment channels to create a omnichannel experience, where different payment channels are connected allowing the customer to seamlessly move from one payment channel to another

Payment Trend 5: Real Time Cross Border Payments

- The growth of instant cross border payments and increased adoption of ISO 20022 XML standards

Deep Customer Insights

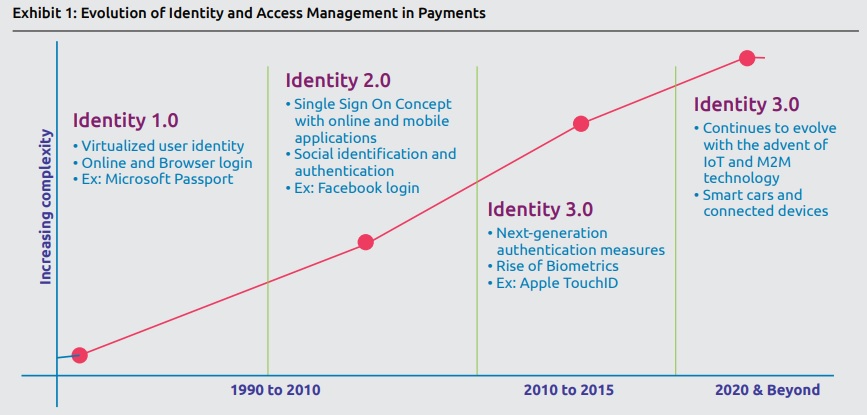

Payment Trend 6: Digital Identity becomes Critical

- The importance of cybersecurity and customer safety drives the need for a Digital identity

Payment Trend 7: BigTech Threaten Incumbents

- BigTech companies such as Google, Amazon, Alibaba, Facebook and Tencent move into financial services, concerning slow moving incumbent financial institutions

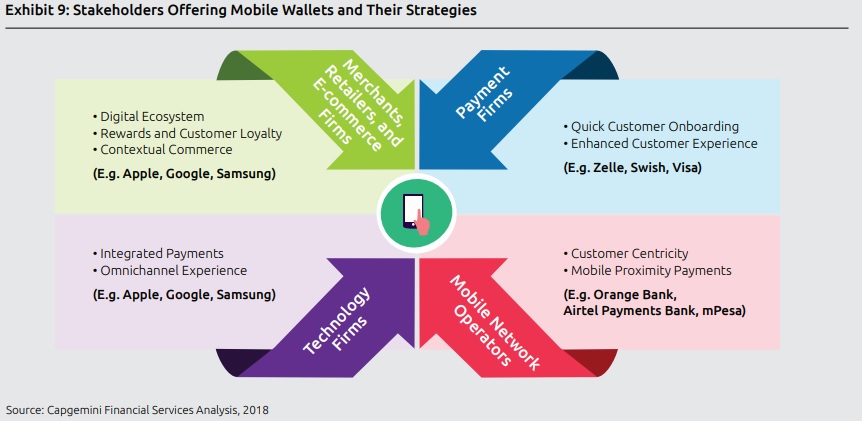

Payment Trend 8: Mobile Wallets

- The move towards digital payment methods will drive and give focus to Mobile Wallet solutions by both payment industry incumbents and newcomers, ultimately mobile wallets will enhance the customer relationship

Data Driven Compliance

Payment Trend 9: Global Regulators focus on Standardisation

- In the last couple of years regulators have been encouraging payment system innovation and modernisation, there may now be a regulatory shift back to standardisation. With the recent increase in the number of products and solutions, regulators will look to rationalise these and ensure stability and reduced-risk

Payment Trend 10: Data Protection

- The above mentioned Open Bank, Intelligent Bank Deep Customer Insights themes highlight the importance for data protection and data privacy in a payment industry that will be increasingly be “open”