Last week Bain & Company published research revealing the real challenge traditional banks face from technology companies. The research highlighted Amazon as the primary threat due to one key factor, trust. In this post, i wanted to summarise the other reasons why Bain believe Amazon could disrupt banking. Keep in mind, this latest research complements earlier Bain research Banking’s Amazon Moment and focuses on the US.

1./ Amazon Interacts Digitally with their Customers on a Daily Basis

Amazon customers in growing numbers are buying, viewing, listening and reviewing Amazon products. Statista data show 95 million Amazon Prime members in the United States as of June 2018.

2./ Amazon already have Customer Credit Card details on record

That’s 95 million Amazon Prime customers with their credit card details on record and already engaged in payment processing

3./ Amazon have Multiple Digital Touch Points with their Customers…

Customers use computers, tablets, smartphones, TVs and home devices to interact with Amazon and their multiple products offerings

4./ … and through Whole Foods have a Physical Touch Point too

Bain indicate that through their Whole Foods stores, Amazon could setup a “light branch footprint” by offering services through video ATMs or service booths.

5./ Amazon could Disrupt Banking through brilliant Customer Service

This almost goes without saying, but arguably traditional banks have not focused on great customer service and new technology providers are now eyeing up dissatisfied customers. Bain share how good customer service, good returns policy and no significant cyber-security breaches so far all put Amazon in “prime” position.

Bain goes on to highlight, this is not by accident. Amazon have spent the past 2 decades focusing on improving the customer experience. Improving the customer experience, Bain suggest, must be a key focus area for incumbent banks if they wish to remain competitive with the tech-newcomers.

6./ Amazon have better Customer Loyalty than Traditional Banks

In a survey of 6000 US consumers, Amazon earned a loyalty score of 47 compared with the regional banks score of 31 and national bank score of 18

65% of surveyed Amazon Prime customers said they would be willing to sign up to a free online bank account with 2% cash back on Amazon purchases. 43% of Amazon non-Prime customers said they would try such an account.

7./ Direct Bank Account access eliminates Interchange Fees

Having direct bank account access eliminates the credit card interchange fees, the earlier Banking’s Amazon Moment report indicated a saving of about $250 million

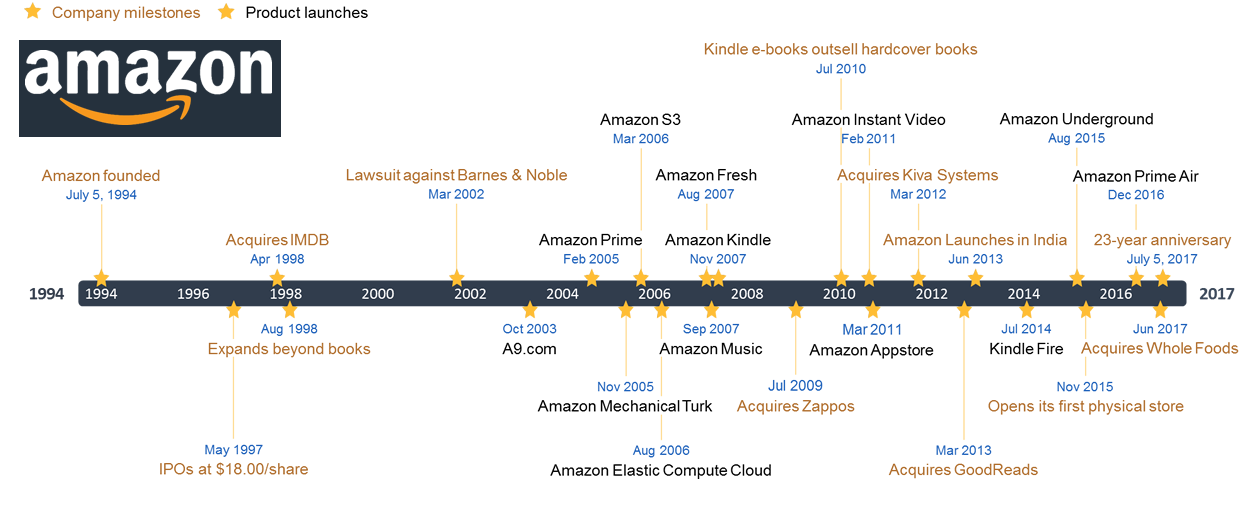

8./ Amazon has a History of Disrupting Stagnant Industries

Since its birth in 1994 Amazon has been disrupting lagging industries and in turn establishing and expanding its own Amazon ecosystem

9./ Amazon would have Direct Visibility & Insights into Customer Finances

By partnering with a bank to launch a co-branded, mobile based, account Amazon will be able to better understand its customers. We all know what that means, Amazon can use this information and data to sell you other products and services. Bain show how this gets particularly interesting because Amazon customers in the US:

- Control 75% of US household wealth

- Prime subscribers control 45% of wealth

- Make up approximately 75% of the wealthiest US households

10./ It’s Possible, Alibaba have successfully moved into Financial Services

Bain share the experience of Alibaba in China, a technology company that move into financial services. Now through its affiliate Ant Financial has in just 4 years is valued at $150 billion – that’s bigger than Goldman Sachs (valued at $88 billion)!!