The cross border payments space has historically been slow, expensive and lacking transparency, making it a perfect candidate for disruption. Incumbent players such as SWIFT are trying, through the SWIFT gpi initiative, to catch up with various fintech and technology companies trying to muscle into this space. IBM is one such example, recently announcing their IBM Blockchain World Wire service. As i read through the blurb, here’s what i learnt:

What is IBM Blockchain World Wire:

Despite the advances in technology and globalisation, say IBM, financial transactions processing has changed very little in the last 50 years. Step forward IBM Blockchain World Wire:

- A new financial rail that can clear and settle cross border payments in almost real time, the new rail…

- Utilises the Stellar Protocol

- For more information on the Stellar Consensus Protocol, i recommend reading

- Stellar Consensus Protocol (SCP): Decentralisation Explained

- Stellar Consensus Protocol whitepaper

- For more information on the Stellar Consensus Protocol, i recommend reading

- Financial institutions transacting together will:

- Agree to use a digital asset (stable coin/central bank digital currency) to exchange value and the digital asset will act as a bridge between any 2 fiat currencies

- Use World Wire APIs from their existing payment systems to convert the first fiat currency into the digital asset

- World Wire will in turn complete the transaction by converting the digital asset into the second fiat currency

- The transaction details will be recorded on a immutable blockchain for clearing

How did IBM “Settle” on a Digital Asset ?

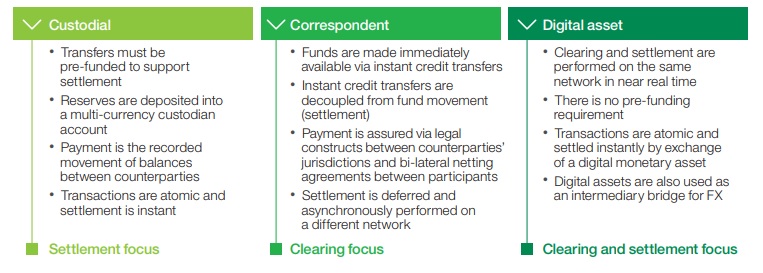

The IBM paper Programmable Money – Will Central Banks take the lead? explores the differences between the 3 blockchain design methodologies for cross border payments:

- Custodial | Correspondent | Digital Asset

The following table nicely summarises the differences between the 3 approaches:

Benefits of IBM Blockchain World Wire:

Similar benefits to other new cross border payment systems:

- Faster

- Simultaneous clearing and settlement

- Removes multiple parties in payment processing

- Minimised disputes and reconciliation times

- Cheaper

- Lower costs to process cross border payments

- Reduced clearing costs

- Cheaper to connect new markets

- More efficient

- A single exchange fee for all currencies

- End to end visibility

- Secure

- Secure network with strong access controls

- Simple to configure and integrate with new systems