Over the weekend i was reading Andrew Hauser’s (Executive Director for Banking, Payments and Financial Resilience) speech in Cambridge regarding the Bank of England’s Fintech Accelerator program. Read the speech for full details, but here is a summary:

Technology Has and Is Transforming Financial Services

Andrew started off describing how technology has and continues to play a critical role in financial services:

- From the telegraph to the ATM (celebrating its fiftieth birthday this year)

- To the very visible application of mobile technology in retail banking

- From screen-based trading to online banking

- To the use of cloud computing, cryptographic techniques and ultra-high speed processors to the wholesale and back office functions

This Fintech Revolution is Different

For those that propose that this Fintech malarkey is nothing new, Andrew suggests it is different because:

- After the financial crisis banks are extraordinary pressure to reduce costs, by some estimates by 35-40%. In order to achieve such cost savings, the financial services sector needs to make transformational changes which only technology can deliver

- Historically competing in financial services required access to expensive standalone systems and communication channels. Now access to technology is much simpler and the cost of technology has drastically reduced – all of which makes it easier for new entrants to access financial services

- Andrew states: “the development of secure internet communications, service-based applications allowing firms to buy as much (or as little) support as they need, open-source code and other key pieces of infrastructure have changed all that, making it radically cheaper to build potentially transformational technologies whilst only incurring the marginal costs of doing so.“

- Huge improvements in customer experience outside of the financial services by the likes of “GAFA” (Google, Apple, Facebook, Amazon) have led consumers to demand the same experience from their banks

- Authorities are encouraging innovation and competition in a bid to deliver improved user experience, bolster financial stability and instigate a move away from operationally vulnerable legacy systems

The Bank of England Getting Dirty

The technological change and innovation that is happening will have significant implications on financial services. The traditional lines are being blurred as conventional financial services are “unbundled”:

- Regulated versus unregulated activities

- Retail versus wholesale

- On-shore versus off-shore

In order to deliver monetary and financial stability central banks, such as the Bank of England, must play a leading role – engaging policy debates, producing and contributing to speeches, policy reports and technical analysis.

The Bank of England, Andrew highlights, is taking this a step further by “rolling up their sleeves and getting their hands dirty with the technology itself.”

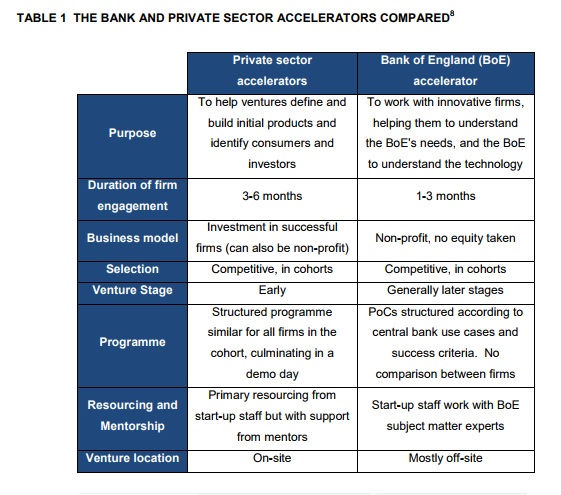

In mid-2016 the Bank of England launches a fintech accelerator project with 2 key objectives:

- To better understand Fintech products, concepts and companies, their strengths and weaknesses and their potential applications in central bank operations

- To give Fintech companies direct exposure to questions and central bank/policymakers/regulator requirements

The Bank of England Fintech Accelerator

The Bank of England over the last 16 months has completed 9 Proof of Concepts (PoCs) across 3 focus areas:

- Distributed ledger technology (DLT) – 3 PoCs:

- Technology is some way from being sufficiently robust or scaleable to form the core of live central bank infrastructure

- A fully replicated ledger poses clear privacy issues, and may be vulnerable to a cyber attack on whichever is the weakest link

- Key Learning: Enabled Bank of England to “…think through how the financial networks of the future may be able to operate in safer and more efficient ways, and how we can ensure they can continue to benefit from access to central bank money”

- RegTech: data storage and analysis / machine learning – 8 PoCs:

- Central banks need make sense of large data sets to discharge their responsibilities, while adhering to increasingly demanding data protection requirements

- A sub-branch of FinTech, ‘RegTech’ has emerged to facilitate the associated monitoring, compliance and reporting demands

- Machine learning uses algorithms to learn iteratively from data, in the short term, this could be used to complement and strengthen central bank analysis and supervisory activity

- Key Learning “how we [Bank of England] can manage ever larger data sets to monitor the economy and the financial system in real time and draw out patterns that might help us set better policy or spot the next crisis coming before it happens”

- Cyber security – 2 PoCs:

- The Bank of England spends significant time on cyber security both for its own systems, and in terms of its requirements and expectations of regulated firms

- Key Learning “take the first baby steps towards engaging with that data in a more interactive way, putting computers alongside our staff to help them form the judgments on which monetary and financial stability depend.”

Check out the speech for full details, since Andrew talks about specific companies and proof of concept details – interesting stuff!

Bank of England Tentative Conclusions

- Gained first hand experience of various new technologies

- Enabled Bank of England to evaluate the application of the technology for both the Banks’ own use and the wider industry

- DLT efforts allowed the Bank of England to

- Establish valuable connections with financial and technology sector

- Exposed the Bank of England to different ways of working and thinking: agile, willing to experiment, less bound by traditional way of doing things

- Fintech firms have seen first hand the needs and thoughts of regulators and policymakers

- Key challenges:

- Customers are loyal to traditional suppliers and only switch if the product is truly innovative

- Widespread adoption requires scaleability and resilience