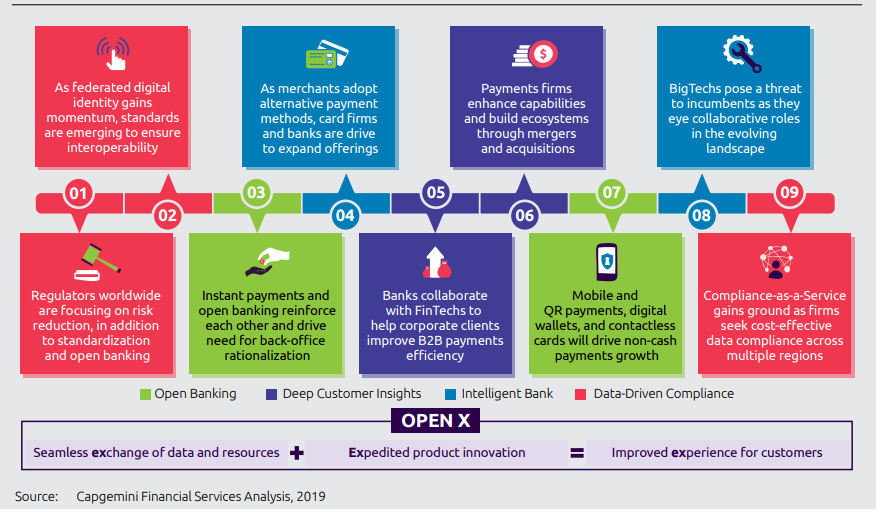

Following on from the recent post recapping the Capgemini World Fintech Report 2020, i wanted to focus on the key payment trends that Capgemini expect to develop over the course of 2020 and beyond. Please refer to the Top Trends 2020 in Payments for full details, following is my recap.

Payment Trends in 2020:

1/ Regulators hone in on Risk Reduction, Standardisation & Open Banking

As disruptive technology and new entrants to the sector increase, regulators prioritise:

- Data protection – think GDPR and other data protection related initiatives

- Open Banking – PSD2 plus other open banking schemes have focused attention on cyber security

- Cryptocurrencies – and the need to address tax evasion and money laundering

- BigTech regulation – in order to create a level playing field for all players

2/ Federated Identity and the move towards Interoperability

The key theme here is the emergence of a Digital Identity (DI) that ensures secure access and data integrity. Many countries are increasingly moving to digital ID schemes, which in turn is creating multiple and disparate systems. This trends considers establishing universal standards that will synchonise these various schemes and enable the digital identity to be used commercially.

3/ New Products (Instant Payments) and Services (Open Banking) expose Bank Back-Offices

The focus on front end processing has, Capgemini state, held back the digital transformation of bank back-offices. Now in the digital world the lines between front- and back- office start to become hazy and this has the potential to disturb the customer experience. Open banking for example exposes the back office (data, systems, channels) requiring digital optimisation and transformation. These back-offices need to move away from legacy systems to:

- Support new products and services

- Handle real time and 24/7 processing

- Cloud hosting for easy deployment and scalability

- Provide as-a-service services

- Enable the move to ISO20022 and other upgrades

- Facilitate omnichannel capabilities

4/ Merchants are prompting Banks to offer additional Payment Methods

Customer preferences are driving/forcing banks to provide and compete with BigTech payment solutions. Drivers include:

- Gen Z and their purchasing power and demand for alternative payment methods

- Economic and customer preferences moving to digital wallets and online/app banking services

- Convenience and faster check out processes

5/ Banks partner with Fintechs to help Corporates improve B2B Payments

Fintech and BigTech companies have made dramatic improvements in the B2C (Business to Consumer) space, and now B2B folks are demanding similar improvements and experiences in their business to business world. Corporate customers want:

- Silos at the bank across accounts payable, accounts receivable, treasury and so on to be broken up and….

- Improved visibility across the entire banking relationship and the end-to-end transaction process

- Banks to be at the forefront of various digital initiatives to support, through insights for example, their own shortcomings and to offer niche products

- Banks to partner with fintechs and BigTech

6/ Payment Firm Mergers and Acquisitions to develop Capabilities and Strengthen

Digitalisation has broken up the payments value chain. This has put pressure on service provider fees and reduced their profit margins, mergers and acquisitions therefore are a way to access new customers and markets, and develop end to end capabilities.

7/ BigTechs are a Threat to Traditional Players as they Look for Opportunities

BigTechs have revolutionised the payment space by adding payments to complement their core business processes. Now these payment and financial offerings have become standalone applications attracting vasts segments of the population and in turn made available new revenues. Their technology-first mantra has disrupted payments by:

- Continuously offering improvements, new products and services to their payment platforms

- Partnering and investing in fintechs

- Making their solutions available in new countries

- Collaborate by investing in startup technology firms

- Utilise their technological expertise to develop new products in new and existing market segments

8/ The Move to, and Increase in, Non-Cash Payment Methods

As cash usage reduces, heightened by COVID-19, the share of non-cash (mobile, QR payments, digital wallets, contactless cards) transactions continues to rise. Key drivers include:

- Reduced costs of internet and mobile devices

- Convenience of mobile payments, digital wallets, QR codes for payments

- Geopolitical and regulatory factors such as demonetisation in India and PSD2 in Europe

- The move to cash-less societies in countries such as Sweden, Finland and South Korea

- Continued e-commerce growth

9/ The growth of Compliance-as-a-Service (Caas)

As data focused regulation becomes more severe, with high fines due to violations and non-compliance, firms are looking to outsource compliance to specialist providers. The key drivers here are cost savings and partnering with a firm that understand the regulatory lingo.

Pingback: 9 Punchy & Powerful Payment Trends for 2020 by Capgemini | SEPA Payments