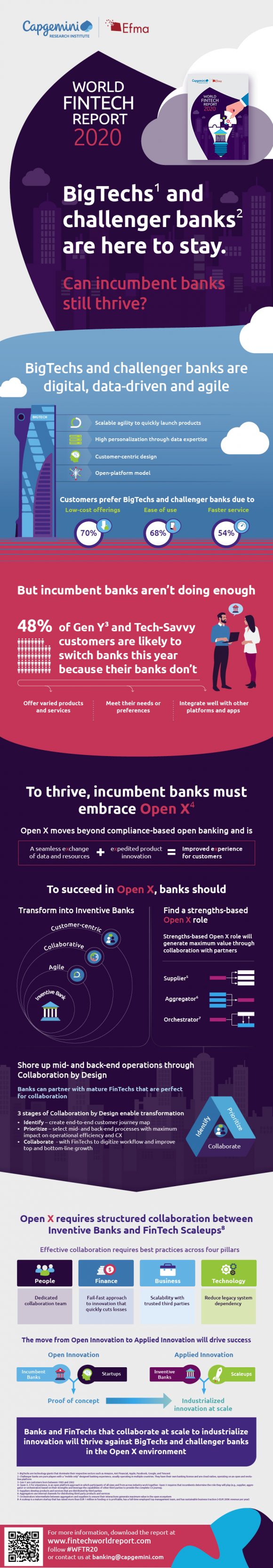

Cap Gemini released their annual Fintech Report last week, and in this post i capture the key themes and share the pretty cool infographic. The title, BigTechs and Challenger Banks are here to stay – Can incumbent banks still thrive, is pretty intriguing. Intriguing because the title alone establishes:

- BigTech is here (in the financial services sector)

- Challenger Banks are here

- Incumbent banks will survive, but can they thrive?

Check out my recap of the World Fintech Report 2019 – Preparing for Open X. You probably guessed it, this year Cap Gemini talk about embracing Open X. See the World Fintech Report 2020 for full details of this years instalment – in the meantime, following is a quick recap:

World Fintech Report 2020 – 4 Key Themes:

Big Tech and Challenger Banks Strengths:

- Digital – operating on an open platform model that integrates with other platforms and apps

- Data driven – allowing customer focused products and services by leveraging the available data

- Agile – scalable technology and cultures that allow products to be launched quickly

- Customer focused – with simple solutions, lower cost products and services, and a faster service

Incumbent Banks need to embrace Open X:

- Open X moves traditional banks beyond compliance for the sake of compliance, nicely explained by Cap Gemini by the following equation:

- Seamless eXchange of data and resources + eXpedited product innovation = Improved customer eXperience

Succeeding in an Open X world requires traditional banks to:

- Transform themselves into Inventive Banks by being:

- Customer focused

- Collaborative

- Agile

- Recognising their strengths in one of the following areas:

- Suppliers

- Aggregator

- Orchestrator

- Strengthen their mid- and back-end operations by partnering with mature fintechs in a 3 step process:

- Identify – by creating the end to end customer journey

- Prioritise – identify the mid- and back-end processes that will have the biggest impact on operational efficiency and Customer Experience

- Collaborate – with Fintechs

Open X demands Collaboration between Inventive Banks and Fintechs across 4 key areas:

- People – a dedicated collaboration team

- Finance – fail-fast mindset to innovation so any dead ends are quickly avoided

- Business – scalable partnerships with trusted providers

- Technology – reduce the dependency on legacy systems

Pingback: 9 Punchy & Powerful Payment Trends for 2020 by Capgemini

Pingback: Overview of The World Fintech Report 2020 by Capgemini (Infographic) | SEPA Payments