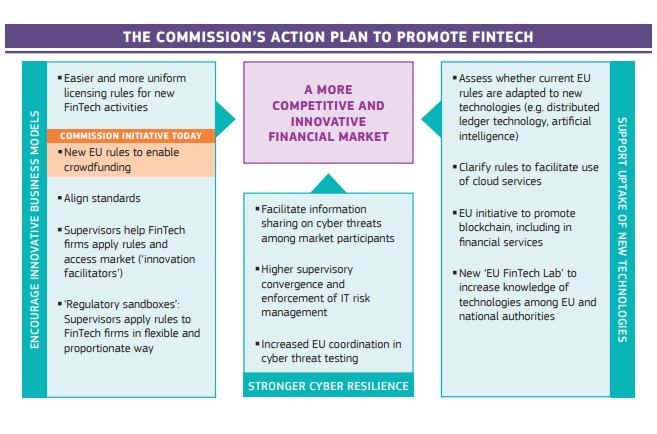

Today the European Commission published a 23 Step ‘Fintech Action Plan’ to help promote more competitive and innovative financial services across the European Union. The Fintech Action Plan press release gives you a quick flavour of the high level plan with the usual focus on blockchain, distributed ledger technologies, digitisation, cybersecurity and crowdfunding with a view to promoting connectivity and collaboration across the EU.

There is quite a lot of information, so for your convenience i thought i would summarise the 23 step Fintech Action Plan to help:

- Build a Capital Markets Union

- Create a truly single market for financial services

- Realise a Digital Single Market

- Formulate rules that facilitate technological advances in the European financial sector

23 Step Fintech Action Plan:

Encouraging Innovative Business Models Across the EU

1.) By enabling clear and consistent licensing requirements

2.) European Commission to propose a EU Regulation on investment-based and lending-based crowdfunding service providers (ECSP) for business

3.) European Commission to ask European Supervisory Authorities (ESA’s) to document existing authorising and licensing processes for innovative Fintech solutions, and highlight future changes and recommendations

4.) European Commission, in conjunction with other EU authorities, to continue monitoring crypto-assets and Intial Coin Offerings and assess if any EU wide regulatory changes are required

5.) Fostering competition and cooperation between companies through common standards & enabling inter-operable solutions

6.) European Commission to create harmonised approach on standards for Fintech by Q4 2018 by working with major standard setting authorities

7.) European Commission supports efforts to create by mid-2019 standardised application programming interfaces (APIs) that are PSD2 and GDPR compliant

8.) Enabling the growth of innovative business models through “innovation facilitators”

9.) ESA’s have already mapped FinTech facilitators established by national supervisory authorities, now the European Commission asks the ESA’s to further analyse and recommend best practices by Q4 2018

10.) European Commission requests authorities within the Member States and EU to take necessary steps to encourage innovation based on the stated best practices, and asks ESA’s to oversee cooperation, coordination and distribution of information around innovative technologies, creation of innovation hubs and regulatory sandboxes

11.) European Commission to report best practices for regulatory sandboxes by Q1 2019

Supporting Technological Innovation in Financial Services

Reviewing whether the rules are fit for purpose, and that the necessary safeguards are in place for new technologies in financial services

12.) European Commission to establish an expert group by Q2 2019 to understand if there are unnecessary regulatory obstacles to financial innovation

Getting rid of restrictions to cloud services:

13.) European Commission welcomes ESAs to explore the assess the need for guidelines on outsourcing to cloud service providers by Q1 2019

14.) European Commission invites cloud partners to cross sectoral self-regulatory codes of conduct that will enable customers to switch between different cloud service providers

15.) European Commission to encourage simplification and enable the creation of standard contractual clauses for cloud outsourcing by financial services providers

Enabling FinTech solutions with the EU blockchain initiative:

16.) European Commission to review the digitisation of regulated information about companies listed on EU regulated markets in Q2 2018

17.) European Commission to work on a strategy for distributed ledger technology and blockchain across all sectors of the economy, including enabling Fintech and RegTech apps in the EU

18.) European Commission has already launched an EU Blockchain Observatory and Forum (Feb 2018), and a study to assess the practicality of an EU public blockchain infrastructure to develop cross border services

Pulling together capabilities and knowledge among regulators and supervisors in a EU FinTech Lab

19.) European Commission to host an EU FinTech Lab (starting Q2 2018) where European and national authorities can meet with technology solution providers, with sessions on various innovations

20.) Using technology to distribute retail investment products across the EU

Improving Security and Integrity of the Financial Sector

21.) European Commission to organise a workshop in Q2 2018 to understand the barriers that prevent cyber threat information sharing between financial market participants, and find appropriate solutions

22.) ESA’s to map by Q1 2019 the ICT security and governance requirements, and highlight recommendations around consolidation and enforcement of such requirements and stating any required improvements

23.) ESA’s to review by Q4 2018 the pros/cons of creating a cyber resilience testing framework for financial sector participants and infrastructures

Pingback: 23 Step 'Fintech Action Plan' by the European Commission - Secure Signal NYC

The European Commission (EC), the executive arm of the European Union, has unveiled a new FinTech action plan designed to help harness the opportunities made available by new technologies like blockchain. In a document titled “FinTech Action plan: For a more competitive and innovative European financial sector,” the EC said that it is planning to form a new FinTech Lab in the second quarter of 2018. The FinTech Lab will allow European and national authorities to engage with tech firms in a “neutral, non-commercial space. ” “The Commission will establish an EU FinTech Lab to raise the level of regulatory and supervisory capacity and knowledge about new technologies,” the EC said.