During the weekend i had a read of the World Economic Forum (WEF) report: Beyond Fintech: A Pragmatic Assessment Of Disruptive Potential In Financial Services. Its an interesting read capturing the key findings of the WEF Working Group, who conducted interviews and 10 regional workshops with experts from across the financial services sector. In this first post i will summarise the successes and failures of fintech startups and the 8 disruptive forces that may shape the financial services industry in the future.

What is a Fintech ?

The WEF report defines a Fintech as a small, technology‐enabled, new entrant to financial services. Interestingly the definition excludes large technology firms that are moving into financial services (such as Apple with Apple Pay), and existing financial institutions that are increasing their focus on technology.

Fintech Startups – Successes:

- Fintech companies are spearheading innovation

- Fintechs are redefining customer expectations and improving the customer experience

- Fintech startups have redefined how financial services are provided, distributed and consumed

- Fintechs have allowed incumbent organisations to outsource innovation and see which products/solutions gain traction

- The sheer number of fintechs offer incumbents an unprecedented number of potential products, which can be accessed through acquisitions/partnerships

- Though many incumbent organisations are unable to move quickly to take advantage of these offerings, or are unable to easily deploy new technologies

Fintech Startups – Failures:

Okay, failure is too strong a word – but lets go with it…

- Fintech companies thought they were going to eat up existing financial services providers, but actually fintechs are needing to partner with incumbents

- Customers are reluctant to move away from established and trusted financial institutions/large technology players

- Fintech companies have not created new or alternative financial rails, rather they have worked within the existing ecosystem and made improvements within it

- Fintechs have not changed the competitive landscape

- The WEF highlights that while Fintech companies have to date failed to disrupt the competitive landscape, the foundations have been laid for future disruption.

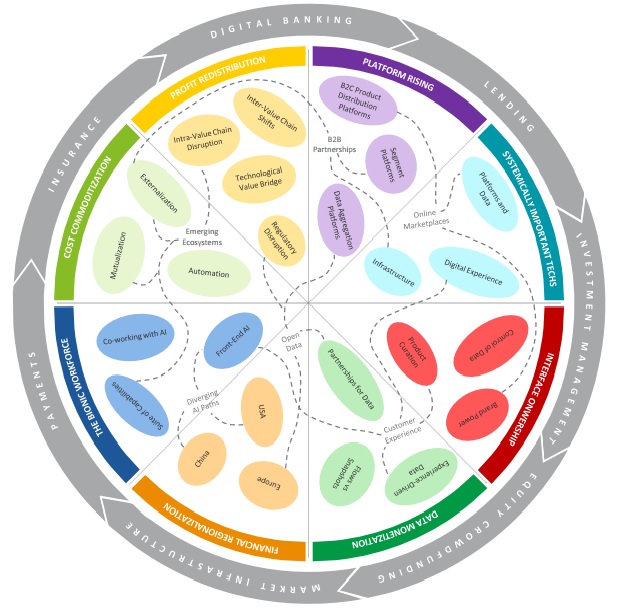

8 Disruptive Forces:

1. Cost Commoditisation

Essentially financial institutions may commoditise their cost bases, by:

- Standardising and avoiding duplication of processes/solutions which in turn removes these processes/solutions as areas of competition

- Outsourcing or partnering with fintech startups/ third party providers to deliver certain services

- Automating processes so that they become more efficient and straight through and in turn lower their operating costs

2. Profit Redistribution

With new and innovative technology and partnerships traditional ways of doing things can be bypassed, which in turn redistributes profit pools.

- Traditional providers are no longer the guaranteed points of entry into certain markets/solutions/products – now organisations have the ability to work directly with new providers

- Technology is allowing customers to switch easily between different products and providers

- New technology and fintech startups are simplifying many traditional ways of doing things, which is disrupting many industries – especially industries with intermediaries

- Regulation is also reducing the amount of control incumbents have over traditional infrastructure/products and enabling new providers to enter these historically “protected” industries

3. Experience Ownership

The WEF explains that power will transfer to the owner of the customer experience and the product distributors. Product distributors can take advantage of:

- Marketing and brand exposure which will allow them to grow their brand

- Product distribution and the presentation of certain products

- Data around the customer and the products they are interested in

4. Platforms Rising

Platforms that allow customers to work with multiple financial institutions from a single channel will dominate

5. Data Monetisation

Data will help organisations to differentiate themselves from each other – and static data will be enriched through feeds from different sources that can be delivered in real time

- Real time data will allow organisations to analyse consumer preferences and habits, target customers and make recommendations

- Organisations are focusing on the digital experience and aiming to increase their engagement with the customer — allowing for more and more data about the consumer to be acquired

- Partnering with companies with a view to collecting and sharing more data about the customer

6. Bionic Workforce

New technologies such as artificial intelligence (AI) will redefine the “workforce” across financial institutions. Increasingly AI in the form of chatbots are being used by financial institutions to handle calls between the customer and the financial organisation

7. Systemically Important Techs

Financial institutions are having to develop considerable tech capabilities (infrastructure/platforms/data/digital experience), and in turn are heavily reliant on tech firms for critical infrastructure and technology

8. Financial Regionalisation

Regulation, technological capabilities and customer readiness/requirements/environment are all resulting in many different financial solutions being developed – each to suit the local conditions. This is a shift away from the one-size fits all model.

Source: World Economic Forum

Beyond Fintech: A Pragmatic Assessment Of Disruptive Potential In Financial Services

Check out the WEF Report – Beyond Fintech: A Pragmatic Assessment Of Disruptive Potential In Financial Services – for full details.

Pingback: 5 Powerful Lessons from Jess Bezos' Amazon Annual Shareholder Letter

Pingback: 5 Powerful Lessons from Jeff Bezos' Amazon Annual Shareholder Letter