Last week Deloitte released an interesting report – SWIFT for Corporates: The real value and cost of connecting to your banks via a single window – which i reviewed and made some notes on. The report provides an interesting insight for companies that maybe considering SWIFT as a connectivity solution, and also a reminder for existing corporates around SWIFT benefits and connectivity options. Please do read the Deloitte report for full details, following are my notes.

Why SWIFT for Corporates?

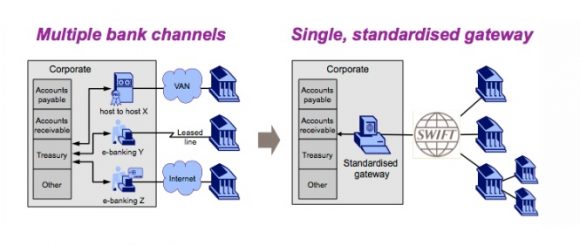

The challenges for corporates:

- Many banking partners across their business operations (country/region/global)

- Many bank communication channels

- As a result of the above

- Many bank interfaces

- Many different ways for end users to interact with their banking partners creating operational burden

- Many interfaces that need to be supported, maintained and upgraded across your organisation

How SWIFT can help:

- SWIFT provides a single, secure and reliable (99.999% availability) connectivity channel that can be used globally (over 200 countries) with most banking partners (about 11,000) and uses standardised financial messaging

- ERP systems and Treasury Management Systems (TMS) can be configured to link through to the SWIFT channel – which enables business processes to be simplified and automated – removing the need for manual processing

- Better security –

- As cyber security threats increase, SWIFT propose they are investing heavily to ensure the best security measures/controls are implemented – SWIFT also have a Customer Security Programme to help reinforce controls at their customer environments

- As you remove manual processing across your organisation, you reduce the ability for users to manipulate payment files

- Scalability – As you deploy SWIFT connectivity, you’re able to re-use and expand the single connection to the SWIFT network to add new countries, banks, payment types

SWIFT For Corporates: Connectivity Options:

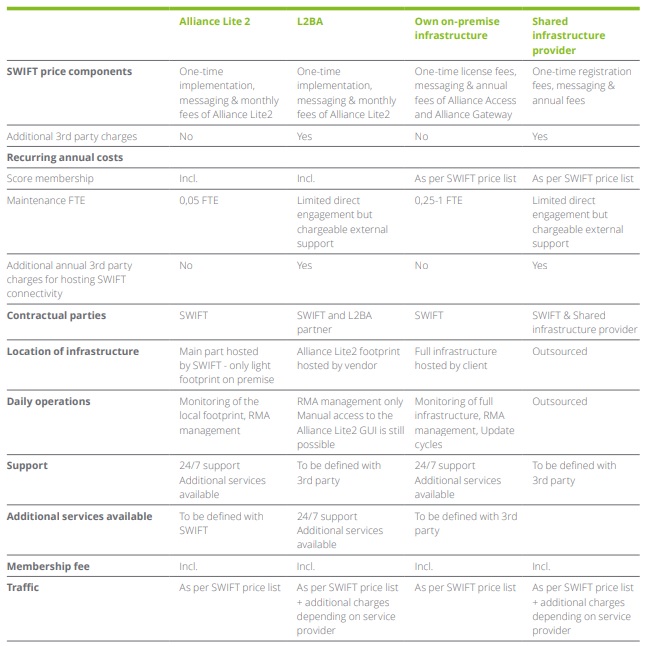

In short, there are 4 ways for corporates to connect to SWIFT:

- Alliance Lite 2 – SWIFT’s cloud solution

- Lite 2 for Business Applications (L2BA) – SWIFT integration through a business application (ERP/TMS) – plug and play

- Alliance Access – SWIFT’s on premise gateway, Alliance Gateway

- Service Bureau – SWIFT connectivity via a third party

Source: Deloitte – SWIFT for Corporates: The real value and cost of connecting to your banks via a single window

SWIFT for Corporates: Costs

This is really interesting analysis by Deloitte. Deloitte explain each organisation will have different costs depending on the number of banks, countries, payment types, ERP systems…. the list continues. But the following gives you an idea of the different costs involved:

- SWIFT messaging costs

- SWIFT has 2 main messaging channels –

- FIN – uses the SWIFT MT Standards to send urgent/high value (MT101) payments to banks

- FileAct – used to send payments in various file formats- such as ISO20022 XML / bank proprietary

- Corporates will be charged for payments sent via the SWIFT network, inbound reporting messages (such as bank statements) delivered over the SWIFT network will not incur a SWIFT charge, although you should be aware that:

- Banks may charge a processing fee

- Your SWIFT service bureau (if you so choose) may charge a delivery fee

- Deloitte analysis indicates a cost of around €170 EUR per message

- SWIFT has 2 main messaging channels –

- Connectivity method costs

- Alliance Lite 2:

- Installation cost: €15,000 – €20,000 EUR – hardware, software, integration

- Annual costs: €6,000 – €15,000 EUR – based on volume

- Alliance Lite 2 for Business Applications (L2BA):

- Installation cost: €15,000 – €20,000 EUR – hardware, software, integration

- Annual costs: €6,000 – €15,000 EUR – based on volume

- Consider: The business application provider will likely charge a fee to maintain/support the infrastructure

- Alliance Access:

- Installation cost: €65,000 – €85,000 EUR – hardware, software, integration

- Annual costs: 20-30% – based on software maintenance, support, volume, type of integrations

- Consider: 0.25-1 full time employee will be required to support, operate and monitor the infrastructure

- SWIFT Service Bureau

- Onboarding cost: €20,000 – €40,000 EUR

- Annual costs: €15,000 – €35,000 EUR for maintenance, support

- Bank Fees

- Keep in mind bank costs will likely exist for other connectivity methods, not just for SWIFT

- Onboarding cost: €0 – €3,000 EUR

- Annual costs: Depends on factors such as number of accounts, volume

- Alliance Lite 2:

SWIFT for Corporates: Some Interesting Facts

Check out the Deloitte report for full details and stats, but in short:

- SWIFT as a communication channel is not solely for large corporates, but should be considered by smaller (revenue less than 0.5 billion USD) companies too

- SWIFT implementations are increasingly using the Alliance Lite 2 and Alliance Lite 2 for Business Applications – ensuring a ‘light’ IT infrastructure footprint

- Corporates with a variety of banking partners are using SWIFT, not just those with many (more than 10) banking partners

The report from Deloitte is a good read, and reiterates the importance of SWIFT as a single and multi-bank connectivity channel. If this is of interest to you, you read joining SWIFT, the benefits of SWIFT and why SWIFT ain’t a magic bullet. Happy Reading!