There is a lot being said about the sharing economy at the moment, and conveniently last month Mastercard released a whitepaper The Sharing Economy: Understanding the Opportunities for Growth. I was reading it last night on the train back from London and in this post will share my notes.

1. What is the Sharing Economy?

There are countless definitions of the sharing economy. Mastercard propose that our natural human instinct to share with one another combined with new technology is enabling “sharing” to happen in unprecedented ways. But what is the sharing economy…

“..a socio-economic ecosystem that empowers people to share underutilised assets directly with others.” – The Sharing Economy, Good Lab, 2016

Examples of the sharing economy are nicely summarised by TechCrunch: “Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate.”

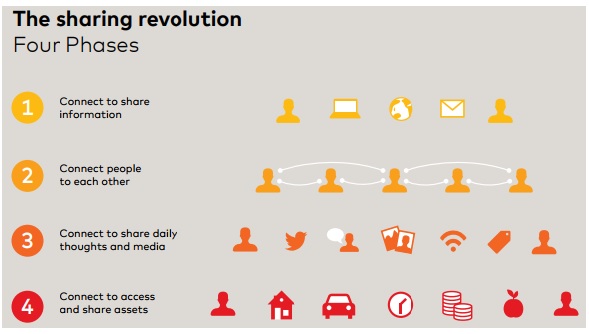

2. The Four Phases of the Sharing Economy:

3. Is the Sharing Economy a Big Deal?

Consider this, the European sharing or collaborative market (by accommodation, transportation, buying/selling goods, on demand professional services, sharing/renting of goods) helped to generate €27.9 billion between May 2015 and May 2016, with around 191 million citizens involved in at least 1 sharing economy transaction with a payment.

And all of the other stats simply point to the continued growth, in fact crazy growth, of the sharing economy.

Future Changes that will shape the Sharing Economy

4. Access to Value

By access to value, Mastercard are referring to the use of technology (mainly new technology) to tap into new markets. You’re probably wondering, which technologies..?

- Blockchain, The Internet of Things (IoT) and Artificial Intelligence (AI)

These technologies change objects or “things” from being static to being active. Once they become active the objects have the ability to connect with people and the world around them. As the connectivity of objects and people increases so too does the opportunity to share.

Mastercard predict that by 2022 1 trillion connected devices will enable better use of resources, increased connectivity and as a result drive the ability to share and create value.

5. Improved Trust & Transparency

Mastercard state “trust remains the key enabler of the sharing economy”, and that trust in the sharing economy requires improvements in technology and regulation.

Regulation:

- Is often too slow and bureaucratic to stay apace with disruptors

- Organisations must partner with regulators to engage and inform regulatory bodies so that the regulators can in turn help influence government present and future responses

- Often the perception is that organisations involved in the sharing economy dodge regulation and abuse market power and workers rights. Participants in the sharing economy need to demonstrate what Mastercard describe as a “more equitable and human sharing for all stakeholders” for this mindset to change

Technology:

- Mastercard raise an interesting point that consumer trust in existing sharing economy platforms is pretty much confined to individual platforms, and there is hardly any transfer of trust between platforms – for example, eBay ratings are meaningless on other platforms such as Uber of Airbnb

- In the future consumers will need greater access and control over their own data, and have the ability to share their data across different platforms

- As the number of sharing economy platforms and services increases, the true winners will be those that offer both a great product and exhibit trust

6. Enhanced Experience

It goes without saying that a better customer or user experience is the key to the success of the sharing economy. The next question is how to deliver an enhanced customer experience in the sharing economy:

- Utilise the Crowd – work with the crowd to get product feedback, and based on the comments make improvements to the product/service. This also gives the crowd (the customer) a sense of control and improves engagement

- Frictionless Transactions – the goal here is to improve the overall customer experience and remove any pain-points. Mastercard suggest that using real time data and AI can enable frictionless transactions

- Personal Data – Some disruptive companies give customers controls of their personal data, changing the dynamic from the company to the individual – this will help to foster trust and enable users to share their data across multiple sharing economy platforms

- Human Touch – Mastercard propose that technology, digital platforms, automation and algorithms are all great, but the brands that can engage customers at an emotional level and offer human-to-human contact are the ones that will truly excel

Interesting stuff, eh?